HSN Code List GST Rate Find GST Rate of HSN Code

Search HSN Codes, GST Rate & SAC codes of goods and services under GST. In India, GST Tax slabs is fixed at 0%, 5%, 12%, 18% and 28%.

GST Rate & HSN Code Chapter 27 for Mineral Fuels Oils

GST and HSN Code Chapter 27 GST Rate and HSN Code Chapter 27: Mineral Fuels, Mineral Oils and Products of their Distillation; Bituminous Substances; Mineral Waxes Hs Codes Chapter

GST Tax Rate on Pumps For Dispensing Fuel Or . 953

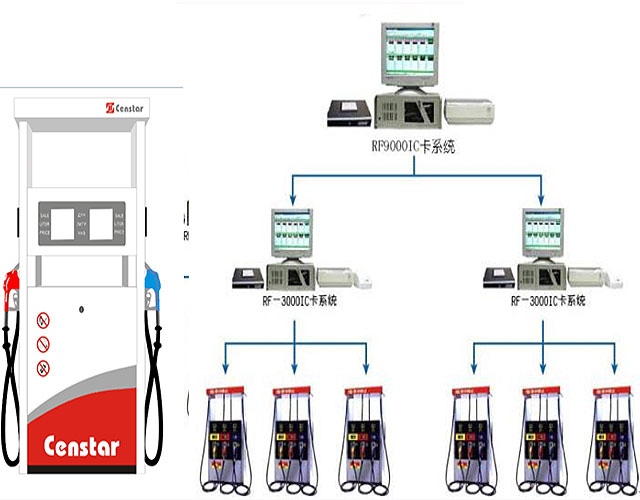

GST Tax Rate on Pumps For Dispensing Fuel Or . 953 Name of Commodity : Pumps For Dispensing Fuel Or Lubricants Of The Type Used In Filling Stations Or Garages Under 8413 11(Except Hand Pumps Under 8413 11 10), Fuel, Lubricating Or Cooling Medium Pumps For Internal Combustion Piston Engines [Under 8413 30], Concrete Pumps [8413 40 00

HSN Code Search HSN Code List GST Rate Finder

Decoding digits of the HSN Code: The GST Council has put two more digits for a micro classification of the products. For a handkerchief made of human fiber, the HSN code is and for a handkerchief made of silk or silk waste, the HSN code is .

GST HS Code and rates for LUBRICANT

Pumps for dispensing fuel or lubricants of the type used in filling stations or garages [8413 11], Fuel, lubricating or cooling medium pumps for internal combustion piston engines [8413 30] Find GST HSN Codes with Tax Rates . GST HS Code and rates for LUBRICANT HS Code, GST rate, find tax rate . KnowYourGST menu. Productsarrow_drop_down.

HS Code 84131191 Harmonized System Code Pumps for

HS Code of 84131191, Pumps for dispensing fuel, Indian HS Classification 84131191, Harmonised Code 84131191, Duty Structure Pumps for dispensing fuel

List and Classification of Services under GST : SAC CODE

HSN code and SAC code are used for classification of goods and services under GST Act and both are applicable from 1st July 2017. All Services are covered under Chapter 99 of GST rate Schedule, till chapter 98 all goods are covered under GST rate Schedule and Chapter 99 has been fixed for classification of services under GST in India.

Import Data and Price of fuel dispensing under HS Code

View detailed Import data, price, monthly trends, major importing countries, major ports of fuel dispensing under HS Code 8413

CBIC GST :: GST Goods and Services Rates

GST Rates ( For Inter state supply, IGST Rate is applicable For intra state supply, CGST rate and SGST/UTGST rate is applicable ) Goods which are not specified in table below have IGST tax rate

GST Rate Calculator for Pumps for dispensing fuel or

GST Rate Calculator for Pumps for dispensing fuel or lubricants in India. Every products have its own HSN code, where Pumps for dispensing fuel or lubricants of the type used in filling stations or garages under 8413 11 (except hand pumps under 8413 11 10), Fuel, lubricating or cooling medium pumps for internal combustion piston engines

HS Code 84212300 Harmonized System Code Oil or petrol

HS Code of 84212300, Oil or petrol filters for internal combustion engines, Indian HS Classification 84212300, Harmonised Code 84212300, Duty Structure Oil

Furnace burners for liquid fuel for GST Rate, HSN Code

The Furnace burners for liquid fuel for pulverised solid fuel or for gas mechanical stokers including their mechanical grates mechanical ash dischargers and similar appliances falls under the category Nuclear reactors, boilers, machinery and mechanical appliances; parts thereof of GST bill and its corresponding HSN code is 8416.

Furnace burners for liquid fuel for GST Rate, HSN Code

HSN Code 8416 The Furnace burners for liquid fuel for pulverised solid fuel or for gas mechanical stokers including their mechanical grates mechanical ash dischargers and similar appliances falls under the category Nuclear reactors, boilers, machinery and mechanical appliances; parts thereof of GST bill and its corresponding HSN code is 8416.

Pumps for dispensing fuel or lubricants GST Rate, HSN Code

The Pumps for dispensing fuel or lubricants of the type used in filling stations or garages under 8413 11except hand pumps under 8413 11 10 Fuel lubricating or cooling medium pumps for internal combustion piston engines under 8413 30 concrete pumps 8413 40 00 other rotary positive displacement pumps under 8413 60 falls under the category Nuclear reactors, boilers, machinery and mechanical appliances; parts thereof of GST bill and its corresponding HSN code is 8413.

GST HS Code and rates for 8413 Serach GST hs code and

Find GST HSN Codes with Tax Rates . Here you can search HS Code of all products, we have curated list of available HS code with GST website. The procedure to find HS Code with tax rate is very simple. In above box you need to type discription of product/service or HS Code and a list of all products with codes and tax rates will be displayed. HS

HSN 8412 GST Rate Other engines and motors (Reaction

Get GST Percentage of HSN Code 8412 Other engines and motors (Reaction engines other than turbo jets, Hydraulic power engines and motors, Pneumatic power engines and motors, other, parts) [other than wind turbine or engine] India

Reduced GST rate on Refrigerator, freezers, water coolers

HSN number: 8418. Refrigerators, freezers and other refrigerating or freezing equipment, electric or other; heat pumps other than air conditioning machines of heading 8415. GST rate before 27th July,2018: 28%. Reduced rate of GST w.e.f : 18%

GST Tax Rate on HSN Pumps for dispensing fuel or

GST Tax Rate: 28%. It contains almost 5000 commodity groups which is being identified by a six digit code. Each group is assigned in a most scientific way along with product description for uniform classification. HSN code is designed and introduced by World Customs Organization (WCO) which is being used by more than 200 countries worldwide including India.

84131110 Pumps for dispensing fuel or lubricants, of the

84131110 Pumps for dispensing fuel or lubricants, of the type used in filling stations or in garages: Hand pumps Search List of Indian ITC HS Code and HS classification System Code, Harmonised System product code, Exim Codes Lookup and HS Code Finder. Inlcudes Harmonized Tariff Schedule.

GST Codes: Find HSN & SAC & GST Rates Tally Solutions

GST Codes: HSN & SAC. Based on the HSN or SAC code, GST rates have been fixed in five slabs, namely 0%, 5%, 12%, 18% and 28%. In the GST regime each invoice will have to mention HSN code for all goods which are sold and SAC code for all services which are provided. Businesses will thus, need to be aware of the HSN code list and SAC code

Message

Message tel

tel Inquiry

Inquiry