FALL 2014 Prepaid Navigator Sunrise Banks

Prepaid Navigator Visa has announced revised standards for chargeback processing of Automated Fuel Dispenser (AFD) transactions in the U.S. region. Effective Ap , Visa will increase the chargeback protection amount at Automated Fuel Dispensers in the U.S. Region from $

Retrieval & Chargeback Best Practices

Retrieval & Chargeback Best Practices A Merchant User Guide to Help Manage Disputes Visa MasterCard Discover American Express October 2015

Merchant Account: Cardholder Activated Terminal Level

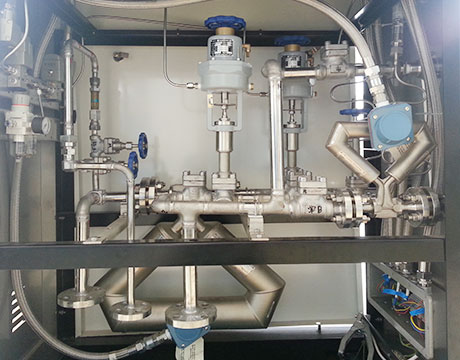

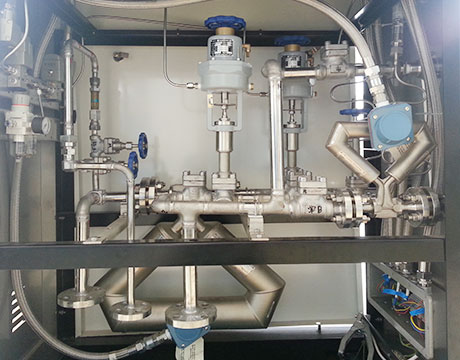

Self Service Terminals do not process PIN. They include (but are not limited to) automated fuel dispensers identified with MCC 5542. All Self Service Terminal (SST) devices must comply with the following requirements: Zero floor limit for authorization purposes. Acquiring banks must read and transmit full, unaltered card read data.

Visa Reason Code 96 Chargeback Expertz

Visa Reason Code 96. Visa Chargeback Reason Code 96: Transaction Exceeds Limited Amount Description. Merchant exceeded the allowable amount limit from a Limited Amount Terminal, a Self Service Terminal or an Automated Fuel Dispenser. Card issuer received a transaction request that exceeds the account’s amount limit.

AFD Transaction myposdepot

Effective Octo , Visa will require automated fuel pump merchants to send an Acquirer Confirmation Advice message within 2 hours after the authorization has been completed showing the amount spent by the cardholder.

Glossary Mastercard Merchant Assistance Mastercard

Automated Clearing House System (ACH) One of the group of processing institutions that have networked together to exchange (clear and settle) electronic transactions. Automated fuel dispenser (AFD) A terminal device used to accept payment for fuel at a petroleum service station. Back to top . B Bank Identification Number (BIN)

Merchant Account: Cardholder Activated Terminal Level

A U.S. region merchant acquiring automated fuel dispenser transactions at Self Service Terminals / Level 2 may forward an Authorization Request / 0100 message for $1 if properly identified by MCC 5542 (automated fuel dispenser) and CAT level indicator 2.

Chargeback Reason Code 75 Chargeback Expertz

Chargeback Reason Code 75. Visa 75 is implemented when there is a listed in billing statement and customer don’t recognize it. Card brand use this code to register claim for both present and previous card transactions. One of the cause is name and location of on the billing statement.

Network Updates Winter 2016 EMV Vantiv

Network Updates Winter 2016 EMV ATM and Automated Fuel Dispenser (AFD) Liability Shift Reminders automatically process Visa and MasterCard chargebacks for EMV Chip Liability Shift (American Express and Discover chargebacks will not be included in the logic at this time). The logic will review the same transaction and

Visa Merchant Business News Digest Visa

This will lead to counterfeit fraud chargeback liability for fuel merchants if AFD EMV chip acceptance enablement is not completed by Octo . Learn more. Visa Partial Authorisation Service: Improve the Customer Experience and Increase Sales. Visa prepaid and debit cards are popular forms of payment at the register.

EMV Liability Shift Delayed Automated Fuel Dispensers

EMV Liability Shift Delayed. New Visa Fraud Monitoring Program for Automated Fuel Dispensers Visa has been working with merchants, acquirers, and fuel industry providers to support migration to the more secure EMV technology. However, due to challenges with EMV Automated Fuel Dispensers (AFD) solution readiness, Visa

Library Visa

Automated Fuel Dispenser EMV Implementation. Fuel dispenser chip card acceptance is the more secure way to accept Visa cards at your fuel dispensers, and the best way to avoid liability for counterfeit fraud. The sooner it is done the better for a number of reasons. PDF 71 KB

Library Visa

The merchant resource library contains in depth information designed to help Visa merchants navigate acceptance, fraud, data security, authorisation and more.

Visa, MasterCard Postpone 2017 Fuel Pump EMV Liability

Visa, MasterCard Postpone 2017 Fuel Pump EMV Liability Shifts for Three Years. The Electronic Transactions Association, the Washington, national merchant acquiring industry trade group, put out a statement early Thursday praising Visa’s decision. “Fuel pumps often feature integrated payments terminals,

Best Practices for Automated Fuel Dispenser Processing

Automated Fuel Dispenser (AFD) merchants authorize a fuel transaction from an unattended pump by submitting the authorization amount as either one unit of currency ( ), or a maximum amount. The “ AFD” method is used in countries that have established chargeback liability limits for AFD transactions (for example, USD

Automated Fuel Dispenser Fraud Mitigation Visa

AUTOMATED FUEL DISPENSER FRAUD MITIGATION • EMV technology helps reduce the value of stolen data. Global market migrations to EMV have proven that chip technology is an effective tool in combatting counterfeit fraud.

What is the Visa Fraud Monitoring Program (VFMP)?

Visa will identify a merchant under the VFMP standard program if it meets or exceeds any of the following monthly program thresholds: Both: USD 75,000 fraud amount 1% fraud dollar to sales dollar ratio . Effective through 31 October 2020 In the US Region: For domestic counterfeit Automated Fuel Dispenser Transactions, both:

Visa Chargeback Reason Code 75 Chargebacks911

In this post, we will outline the specifics of Visa chargeback reason code 75. What is Reason Code 75? Visa cardholders will use chargeback reason code 75 when they see a charge on their account that they do not recognize. MasterCard’s corresponding reason code is 4863.

Official VISA Release: U.S. Automated Fuel Dispenser EMV

Official VISA Release: U.S. Automated Fuel Dispenser EMV Liability Shift Delayed to 2020. The expanded monitoring program will have unique thresholds based on U.S. AFD counterfeit fraud trends. For AFD locations that exceed the defined thresholds and reach enforcement status, issuers will receive chargeback recovery rights for reported counterfeit fraud.

U.S. Automated Fuel Dispenser EMV Liability Shift Delayed

2 U.S. Automated Fuel Dispenser EMV Liability Shift Delayed VFMP AFD Program Program Basics The VFMP AFD program applies only to U.S. domestic transactions at AFDs (Merchant Category Code 5542). The VFMP will continue to operate as currently defined in the Visa Rules (ID#: 0029288).

What is the fraud liability shift and when is it? EMV

The U.S. fraud liability shifts start taking effect in October 2015 for POS payment devices. The only exception is the Automatic Fuel Dispenser (AFD) which has a fraud liability start date of October 2017. October 2015 is applicable across all global payment networks: American Express,

Merchant Accounts For Automated Fuel Dispensers Credit

Petrol and Gas stations use these fuel dispensing machinery. Automated fuel dispensers are used to pump fuel into vehicles fuel tanks. It is essential equipment for gasoline service stations in which customers make payments by using various modes. Either they can pay by credit or debit card, or else they can pay by cash. Automated fuel dispensers work on computer program without the help of

Network Updates Fall 2015

Worldwide and Visa ® U.S.A. regarding › October 2017 Automated Fuel Dispenser merchants have extended timeframe in consideration of chargeback protection timeframe, or to only extend the chargeback protection amount when the incremental authorization is submitted with a

Minimum Chargeback Amounts for Visa Cards Chargeback Expertz

The minimum amount applied to ‘Automated fuel dispenser transaction ’ under Visa chargeback code 81 is $ or any other currency equivalent to it. The conditions on which this minimum amount is applicable are: If the cardholder does not authorize or participate in a ‘Card present’ environment. This condition is applicable in all the regions.

Chargeback Reason Code 75 Chargeback Security

Visa Chargeback Reason code 75 doesn’t apply: When cardholder makes a claim that transaction wasn’t authorized, or it was fraudulent. The transaction was executed via telephone service. Acquirer gave evidence for the transaction. A pin authorized debit transaction. It was a passenger transport transaction or automated fuel dispenser.

April 2019 Payment Network Pass Through Fee Schedule

Visa Partial Auth NP Trans Fee $ Applies to Visa and Interlink Automated Fuel Dispenser (MCC 5542) transactions where the Partial Authorization Indicator =

Visa Merchant Business News Digest Visa

The EMV liability shift for US domestic Interlink automated fuel dispenser (AFD) transactions has been delayed until 1 October 2020. Visa will expand its current Visa Fraud Monitoring Programme (VFMP) to help mitigate counterfeit fraud for these transactions at US AFDs during the interim period.

How to Combat Post EMV Chargebacks US PAYMENT SYSTEMS

If neither or both parties are EMV compliant, the fraud liability remains the same as it is today. This date excludes automated fuel dispensers. Octo Counterfeit Card Liability Shift, Automated Fuel Dispensers. This extends the card present counterfeit card liability shift to transactions from automated fuel dispensers.

Best Practices for Processing Chargebacks Related to the

To help ensure accurate and efficient chargeback processing, Visa is outlining some best practices and reminders. 1 Excluding automated fuel dispenser (AFD) and ATM transactions until 1 October 2017. that have a Central Processing Date (CPD) before

Visa U.S. Fuel Merchant Automated Fuel Dispenser Fraud

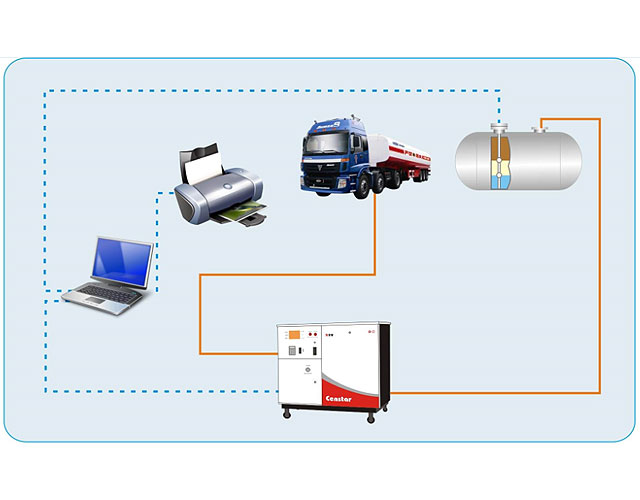

Visa Transaction Advisor (VTA) for U.S. Fuel Merchants Visa Transaction Advisor is a service being used by merchants to help reduce their fraud through Visa risk intelligence data sharing to help in determining the likelihood of fraud How it works Consumers use their Visa cards at a participating automated fuel dispensers (AFDs) Each transaction is

Visa Minimum Chargeback Amounts Chargeback

Visa Chargeback Reason Code 81 Fraud Card Present Environment. The minimum chargeback amount of $10, or local currency equivalent, applies to automated fuel dispenser transactions categorized under Visa chargeback reason code 81

Understanding the U.S. EMV Liability Shifts

PULSE, SHAZAM, STAR Network and Visa Lastly, the networks identified above have also announced the counterfeit liability shifts for automated fuel dispensers. The chart below gives specific information for each of these networks regarding their AFD liability shifts. 5 Data from a contact chip card.

UPCOMING PAYMENT SCHEMES RULES CHANGES

UPCOMING PAYMENT SCHEMES RULES CHANGES Sara Novakovič, Dispute Operations Department MasterCard Visa American Express Chargeback Guide • Authorization related Chargeback • Cardholder Dispute Chargeback • Fraud related Chargebacks CHIP LIABILITY SHIFT DELAYS FOR U.S. REGION AUTOMATED FUEL DISPENSER MERCHANTS MasterCard announced

Visa Chargeback Reason Code 96: Transaction Exceeds

Visa Chargeback Reason Code 96: Transaction Exceeds Limited Amount. Most commonly caused by processing a transaction from a Limited Amount Terminal and exceeding $25, processing a transaction from a Self Service Terminal (including AFD) and exceeding $50, processing a transction from an Automated Fuel Dispenser and exceeding $75 for Visa Corporate

Omni Merchant Network Updates Winter 2017 Vantiv

5542 Automated Fuel Dispensers. The Change: As a result of the complexities and challenges of implementing EMV at AFDs, a delay in the U.S. Automated Fuel Dispenser (AFD) EMV Liability Shift was announced (in early December) by Visa, MasterCard, American Express and Discover.

Merchant Category Code List ChargebackHelp

But most importantly, for payment processing purposes, these codes are used to classify whether a merchant is a high risk for fraud and chargebacks. If your business is identified under a high risk MCC, you have to be extra vigilant against processing fraud and chargebacks. Failure to do so can cost you the ability to process payments by credit

Chargeback Guide Chargeback Reason Code 75

Visa Chargeback Reason code 75 doesn’t apply: When cardholder makes a claim that transaction wasn’t authorized, or it was fraudulent. The transaction was executed via telephone service. Acquirer gave evidence for the transaction. A pin authorized debit transaction. It was a passenger transport transaction or automated fuel dispenser.

Visa Chargeback Reason Code 72: No Authorization

Visa Chargeback Reason Code 72: No Authorization. The issuing bank received a transaction for which authorization was not obtained. The most common cause is not obtaining an authorization for a transaction or, for card present, obtaining it after the transaction date. For Automated Fuel Dispenser (AFD) transactions, the issuing bank may only chargeback for amounts exceeding certain thresholds.

How to Navigate the EMV Liability Shift Worldpay Vantiv

Yes. Because of the cost of upgrades and other factors, dates for the liability shift were extended for automated fuel dispensers (AFD) and ATM machines. The Mastercard ATM EMV liability shift took place in October, 2016, while Visa and the other major card brands gave ATM operators until October, 2017 to become EMV compliant.

Chargeback Reason Code 75 Chargeback Security

It was a passenger transport transaction or automated fuel dispenser; Responding to Visa chargeback reason code 75. Media Needed: A receipt with swipe. If card is not present then invoice, proof of delivery, AVS results, and CVV2 results will work. Merchant Response:Provide information or documentation that will help recognize the transaction

Visa U.S.A. Interchange Reimbursement Fees

Visa U.S.A. Interchange Reimbursement Fees The following tables set forth the interchange reimbursement fees applied on Visa financial transactions completed within the 50 United States and the

MasterCard Revises Standards for Processing

Support of Revised Standards for Processing Authorizations and Preauthorizations Changes not applicable to: Automated Fuel Dispenser (AFD) MCC 5542 Contactless transactions Transit aggregated or debt recovery transactions Preauthorizations or authorizations with

Purchases & Disputes with My RushCard: FAQs

However, if you use your Card at an automated fuel dispenser ("pay at the pump"), the merchant may preauthorize the transaction amount (place a hold) on your Account of up to $ or more. This may cause your Card to be declined even though you have sufficient funds

Counterfeit Fraud Mitigation Tools for Automated Fuel

COUNTERFEIT FRAUD MITIGATION TOOLS FOR AUTOMATED FUEL DISPENSER TRANSACTIONS Address Verification Service (AVS) Address Verification Service verifies the billing statement postal code of the customer who is paying with a Visa card at an AFD. The postal code is included in the authorization request message to Visa.

Retrieval & Chargeback Best Practices First Data

Developed by: First Data Payments Compliance Rev 04/17 Confidential & Proprietary to First Data 23 of 234. Scenario #2. A chargeback was received from the issuer for reason code 57. The cardholder contacted their bank to notify them of fraudulent transactions posting to their account.

Message

Message tel

tel Inquiry

Inquiry